Time needed: 5 minutes.

ONLINE BIKE RENTAL

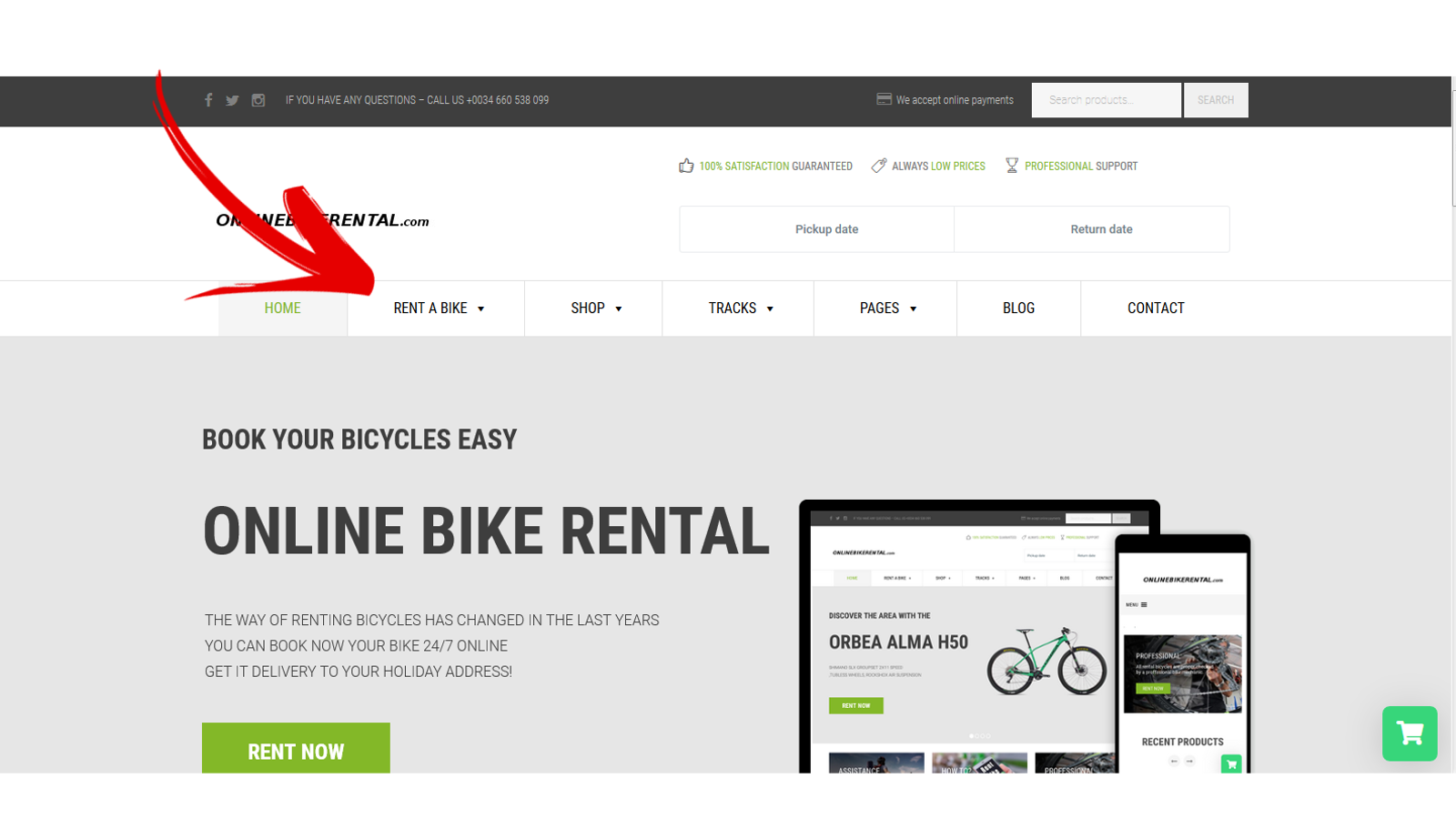

- Klik on Rent a bike

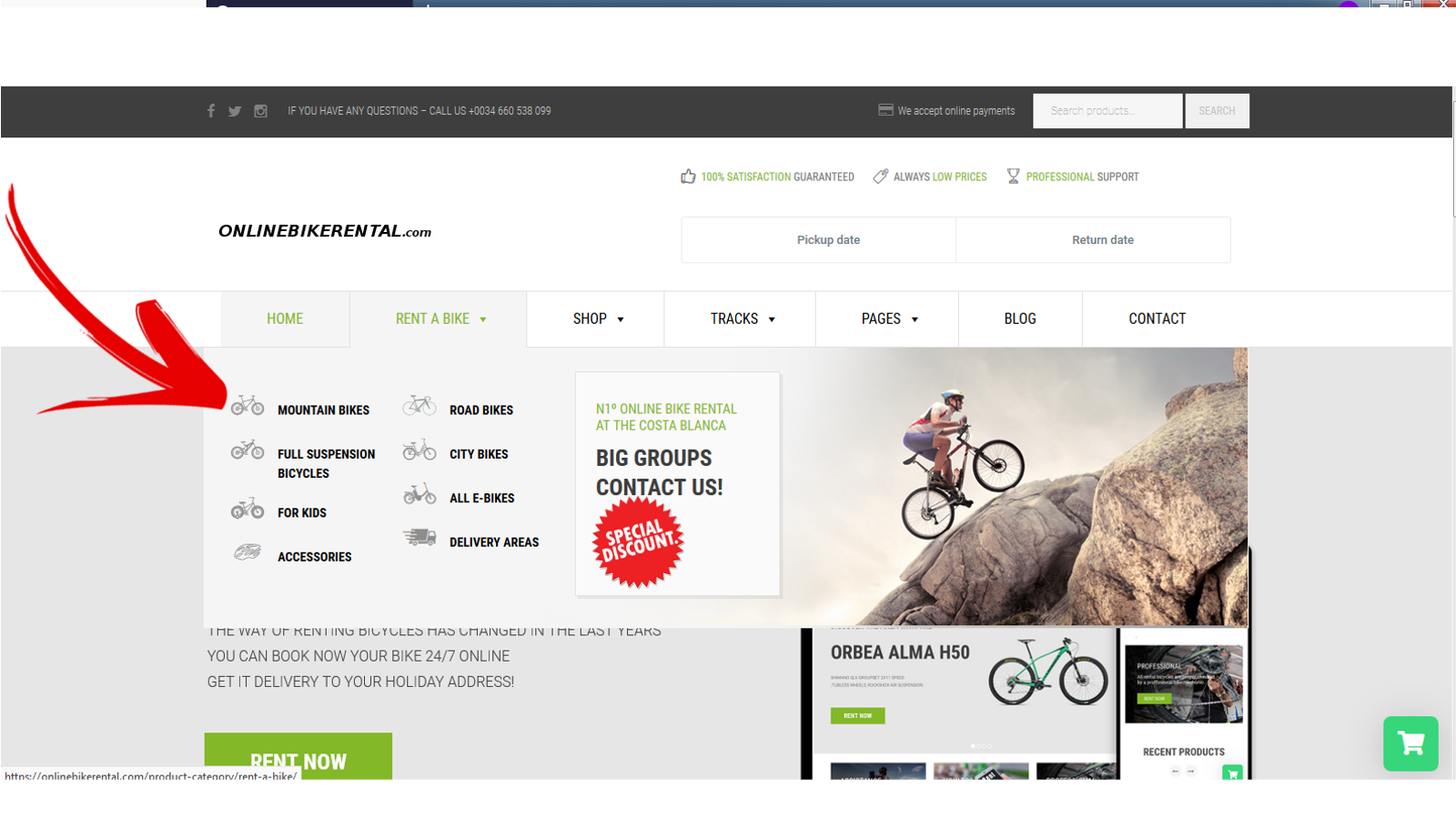

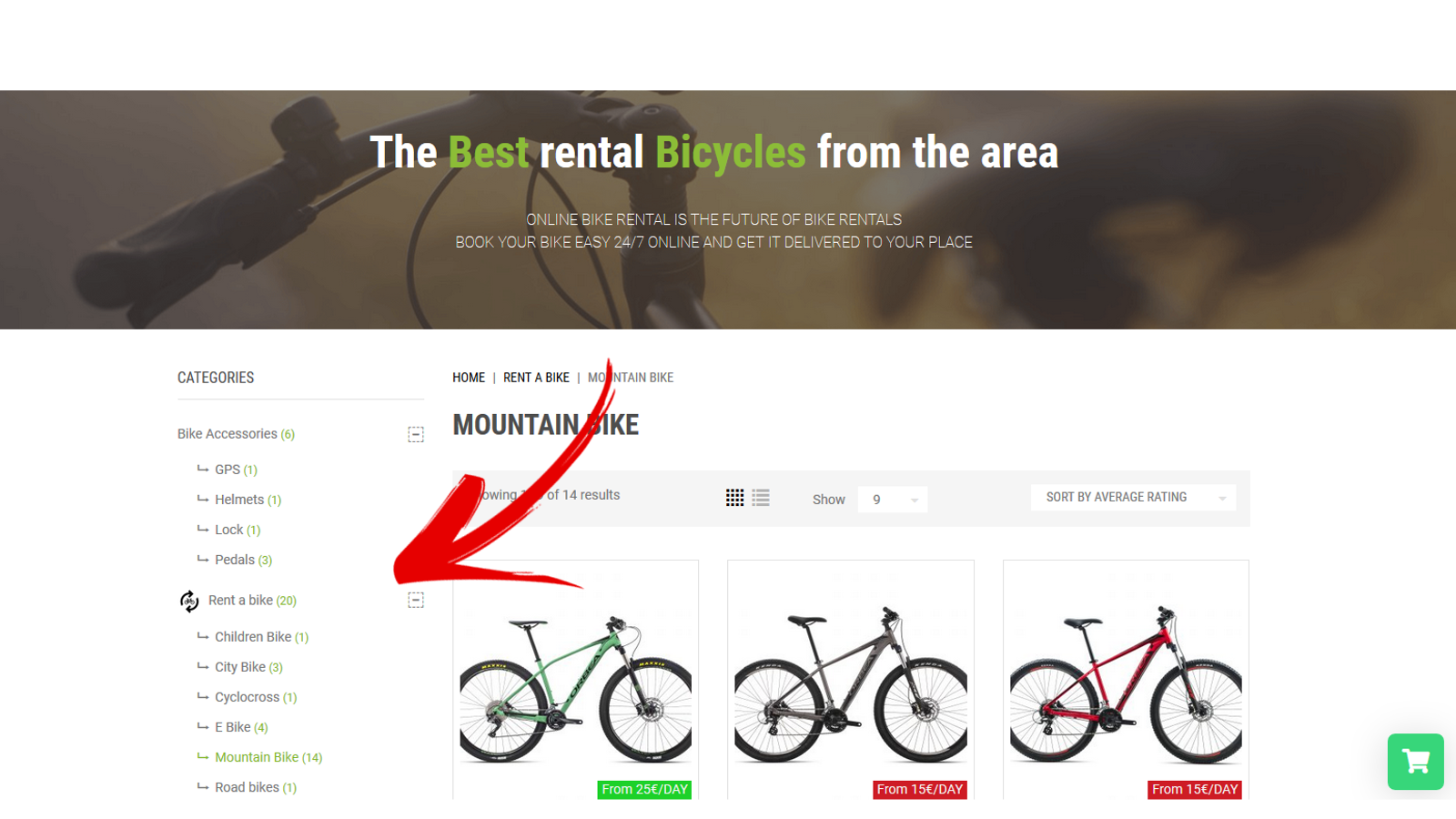

- Choose type of bicycle that you would like to rent

- If you go bellow in this menu you can choose your frame size, groupset and you can also filter the price per day.

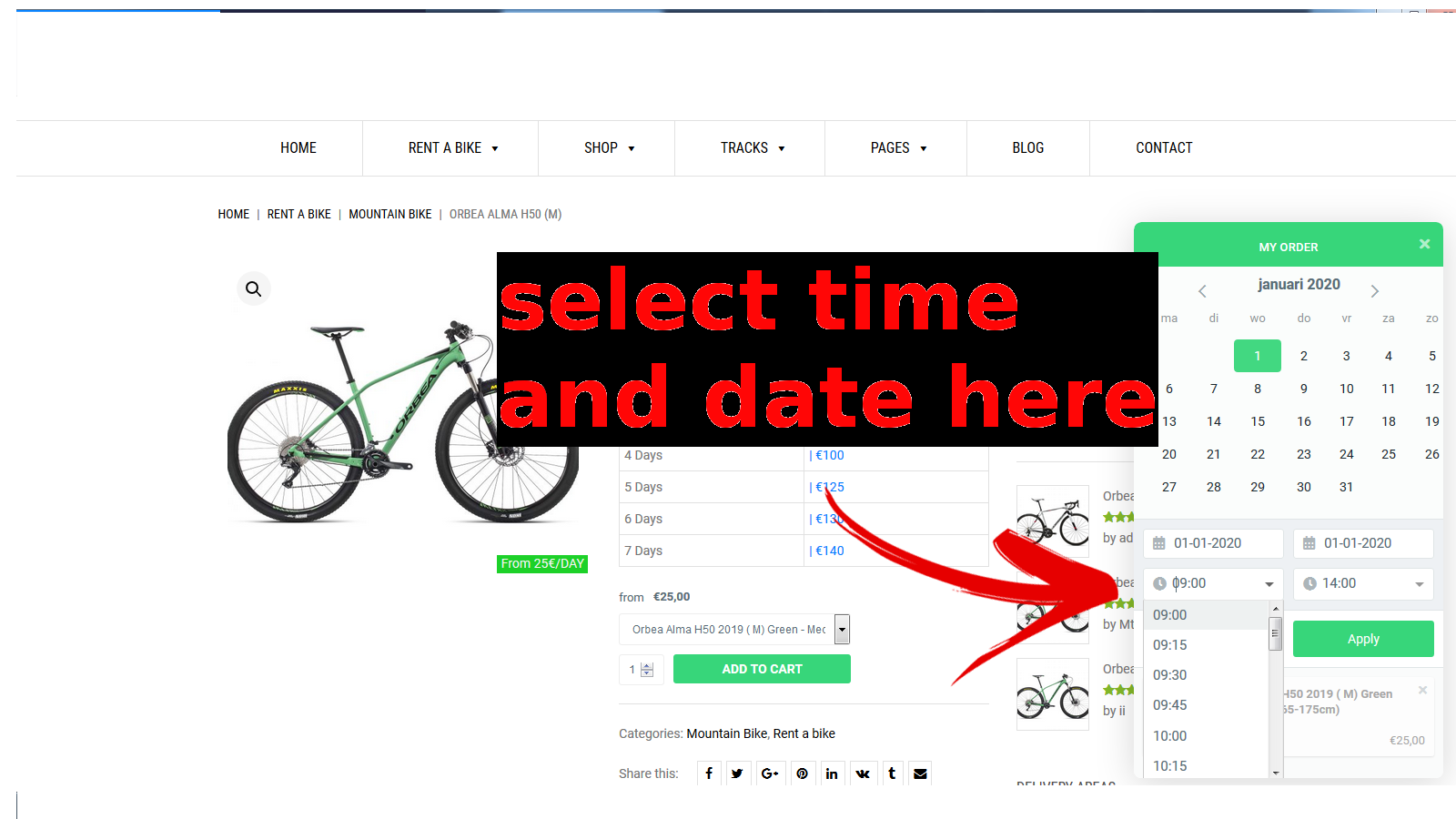

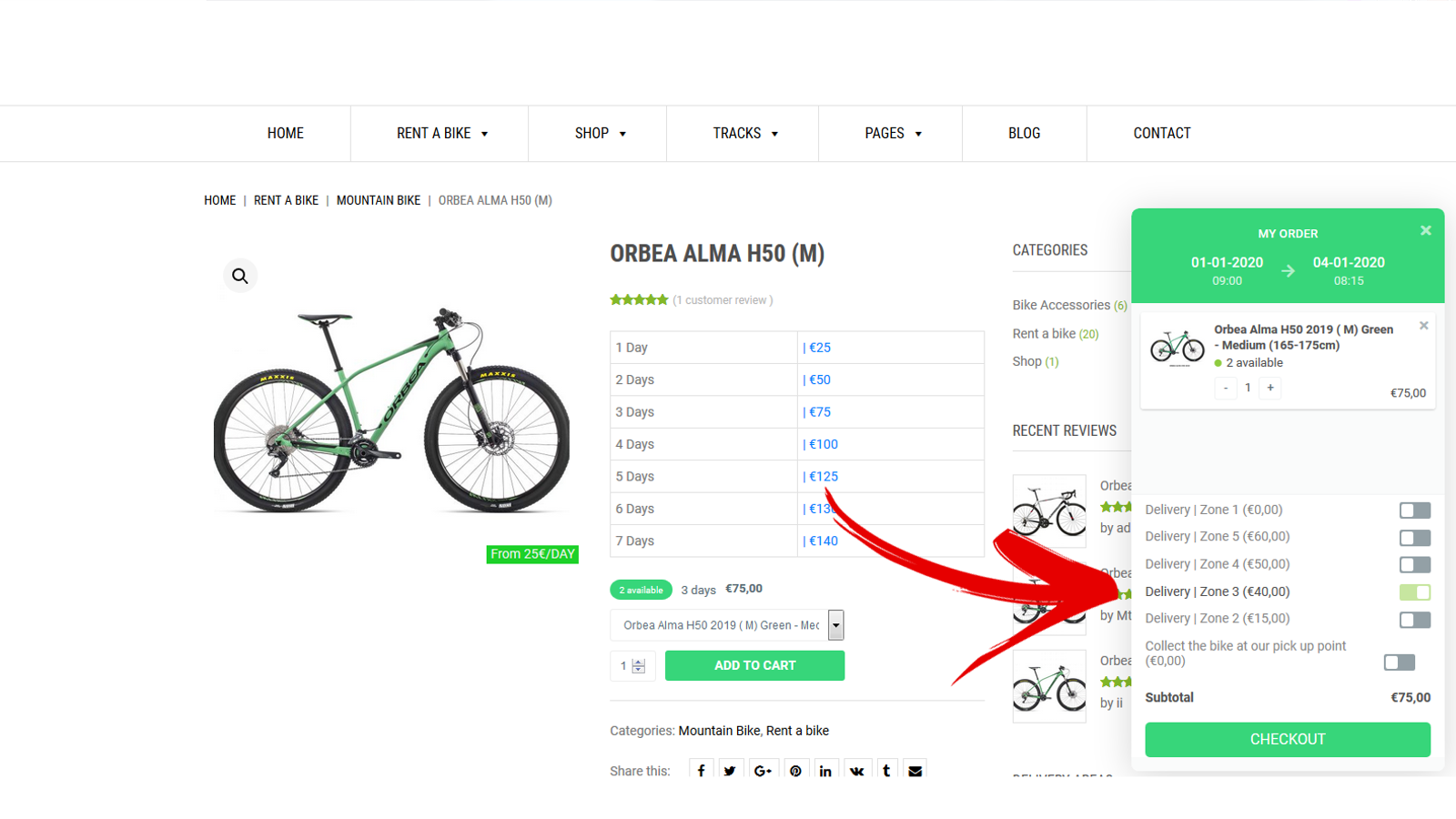

- After you have clicked on the bicycle that you like the most click on add to cart.

After you clicked on add to cart the calendar will appear.

Choose the prefered time and date that you would like to rent the bicycle/s.

After the chosen time and date the price will apearautomaticly .

ATTENTION the delivery time can sometimes be different than selected!

- Delivery.

Choose the delivery area right there.

If you don,t know in what zone you are you can check here your zone: https://www.google.com/maps/d/u/0/viewer?mid=1dkf1j-_Eb5Gr4MxY7XjYW7I7j-X6LKFW&ll=38.02820238200247%2C-0.8833806000000095&z=9

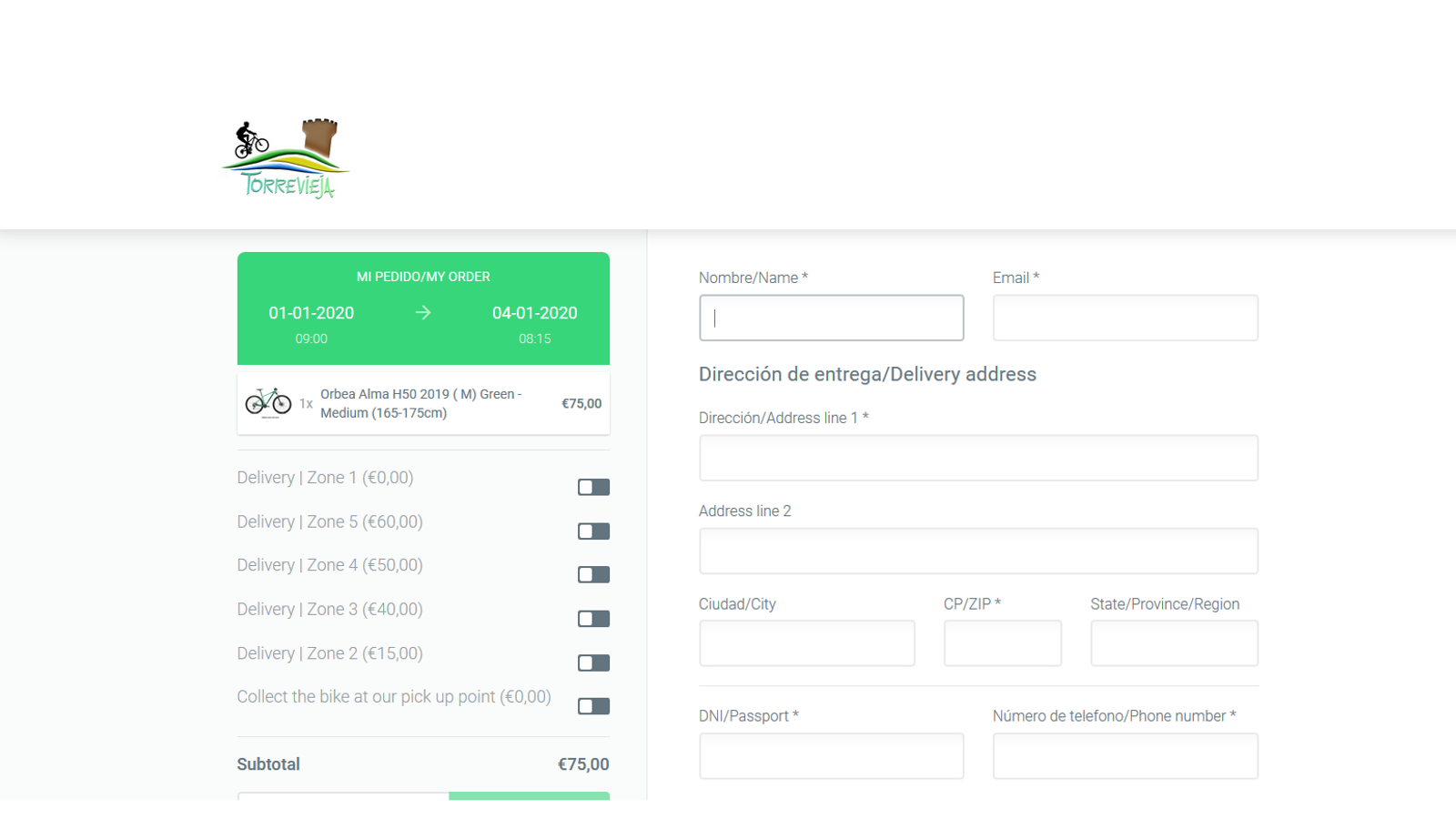

- Fill in your personal details.

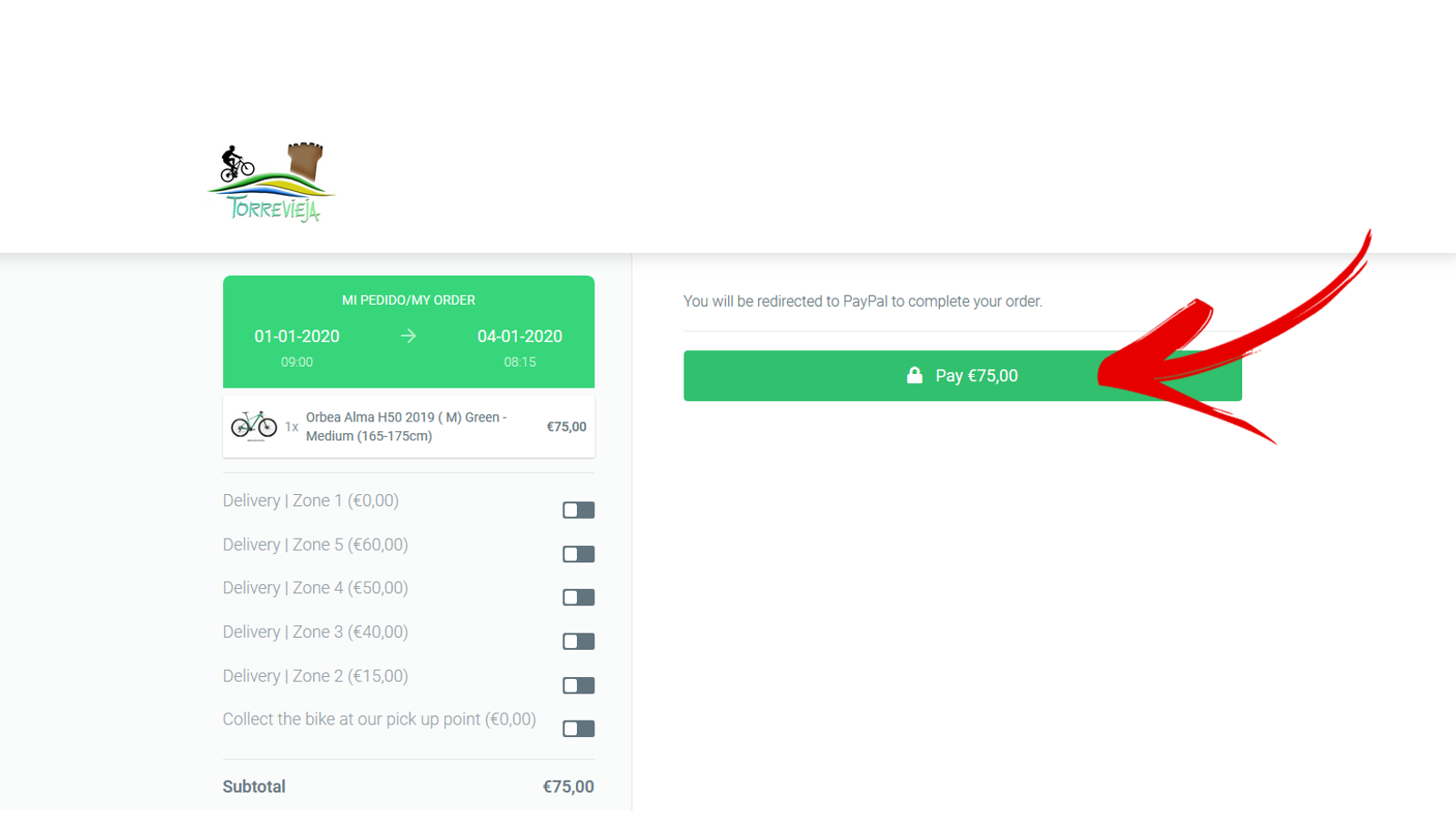

- Proceed to the payment for to confirm your booking.

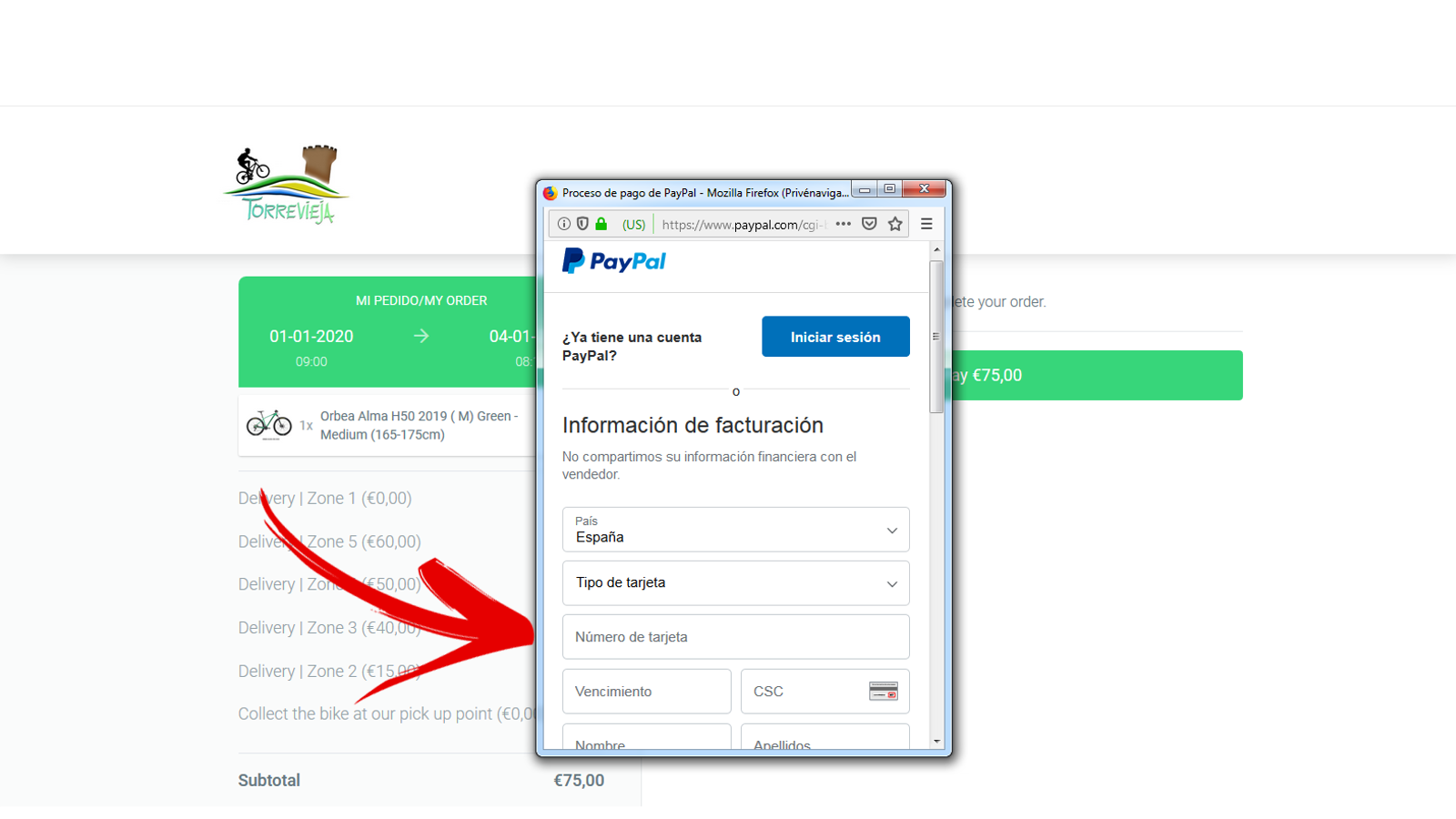

- The last step, make the payment with your credit card.

Important if you didn´t do the payment the booking is not confirmed!

The security deposit is done the same day when we deliver you the bicycles it can be done with a card or cash

Why do you have to pay a deposit?

in case you break the bicycle or when its

How much is the bike rental deposit?

bike hire deposit amount can be anything from €200 to €1500

How will you pay the deposit?

Most companies will block the deposit on the main credit card. You won’t be able to use anyone else’s card. ‘Blocking’

Authorization hold

From Wikipedia, the free encyclopedia Jump to navigationJump to search

Authorization hold (also card authorization, preauthorization, or preauth) is the practice within the banking industry of verifying electronic transactions initiated with a debit card or credit card and rendering this balance as unavailable until either the merchant clears the transaction, also called settlement, or the hold “falls off.”

In the case of debit cards, authorization holds can fall off the account, thus rendering the balance available again, anywhere from one to eight business days after the transaction date, depending on the bank’s policy. In the case of credit cards, holds may last as long as thirty days, depending on the issuing bank.

The main reason for authorization holds is where there is a two-step process in the payment, consisting of an authorization and a settlement with a time lag in between. These were common with signature-based (non-PIN-based) credit and debit card transactions where a transaction was authorised but not settled until a few days later. It is also common in hotel, rental car services or on pay at the pump at filling stations where the company wants to confirm a valid method of payment has been received prior to providing services or goods and knowing the amount that will be charged.

The major consequence for the user is that they cannot access that part of their account until the authorization hold expires without being finalized or is settled and the banking system transfers the funds. If the account balance is low this could result in an unavailable funds fee. The actual balance will not be reduced until the merchant submits the batch of transactions, and the banking system transfers the funds.